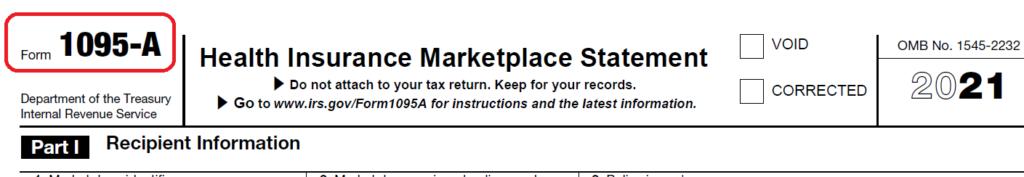

Need Help Finding your 1095A Tax Form? We can help!

Every spring we get many calls and emails from people looking for their 1095-A form. I’m putting this together a step-by-step overview on how to find it on the Washington HealthPlanFinder. It’s not easy to find the 1095-A form, so it’s the system, not just you. If you need help, we are expert health insurance brokers. You can call or text us at 425-802-2783 or email us at health@achieve-alpha.com and can get it to you quickly.

If you are getting WA Exchange email notifications, one issue we have found is that often notifications go to your SPAM or JUNK folder. We recommend adding the HealthPlanFinder emails to your good email list and check SPAM folder.. If you are getting physical mail, you will not get emails. You can only do it one way or another.

Tax Credits for health insurance are for the year you are in, and you generally pay about 8.5% of your MAGI (Modified Adjusted Gross Income) towards individual health insurance premiums. For example, a household of two people during Open Enrollment in 2021 you estimate making $50,000 for the year 2022. When you get your 1095-A form for 2022 and made more money (let’s say $70,000 total) than you input into the HealthPlanFinder you might owe back let’s say $141/mo or $1,700. The system reconciles, so you can’t game the system of getting more tax credits than you actually are able to receive. It also goes the other way. If you estimated making $70,000 and actually only earn $50,000 you would get a refund of $1,700. As you make more or less money throughout the year you are supposed to update it. If you ever get an ACTION REQUIRED document for updating your income, you MUST do it within the time frame or risk losing coverage. Income can change from year to year and the system sometimes asks for proof of your income. If you want to get tax credits you MUST file a tax return, no matter your income.

Below are the steps to find your 1095-A form:

- Log into your HealthPlanFinder Account. No we don’t have your password, you can reset it easily by clicking on forgot username or password when trying to log in.

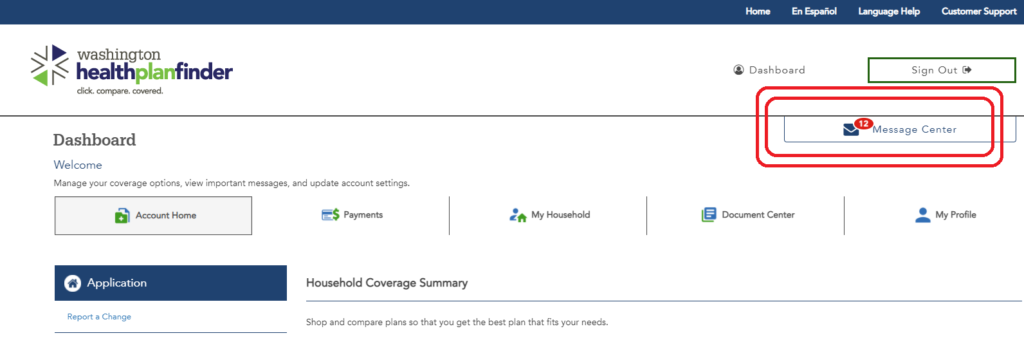

- Click on the Message Center Mailbox Icon, see below. Every email or letter ever sent to you is here.

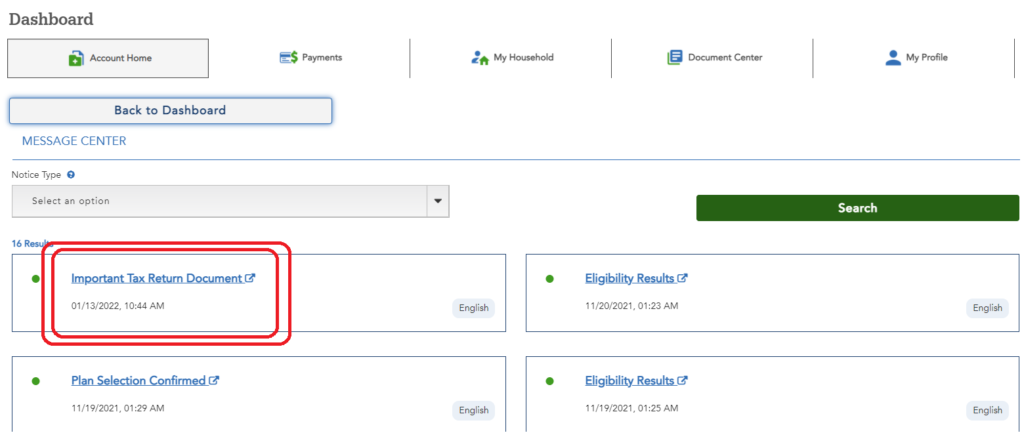

- Click on the Important Tax Return Document link. They send it to you via email or physical mail about January 15th of every year. Yet can find it this way as well.

- If you do NOT have a 1095-A form in your HealthPlanFInder account, 99% of the time that means you paid the full price for health insurance and did NOT get tax credits up front. If your income is low enough for you to get tax credits at the end of the year your accountant or accounting software can do the calculation for you.

5. Once you are into the HealthPlanFinder Click on the Message Center.

6. Once you log into the Message Center, click on the Important Tax Return Document link. You might need to keep going to the next page until you find it in the history of documents sent to you.

We hope this brief overview of how to find your 1095-A form was helpful.

Gary Franke, Tamara Chandler, Brianna Crawford & Melissa Tibbs

Heffernan Insurance Brokers

Individual Health & Medicare Specialists

1100 Bellevue Way NE, Ste 8A-545

Bellevue, WA 98004

425-802-2783 (call or text office line)

wahealth@heffins.com

www.wahealthplan.org