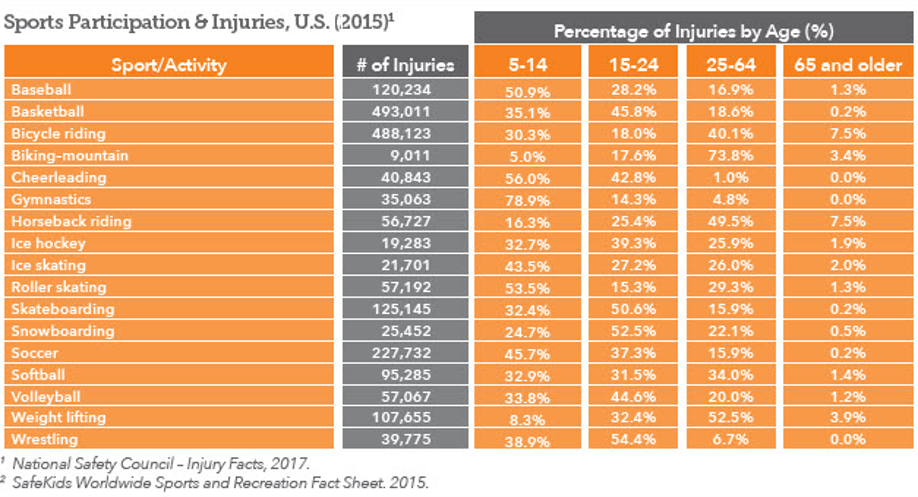

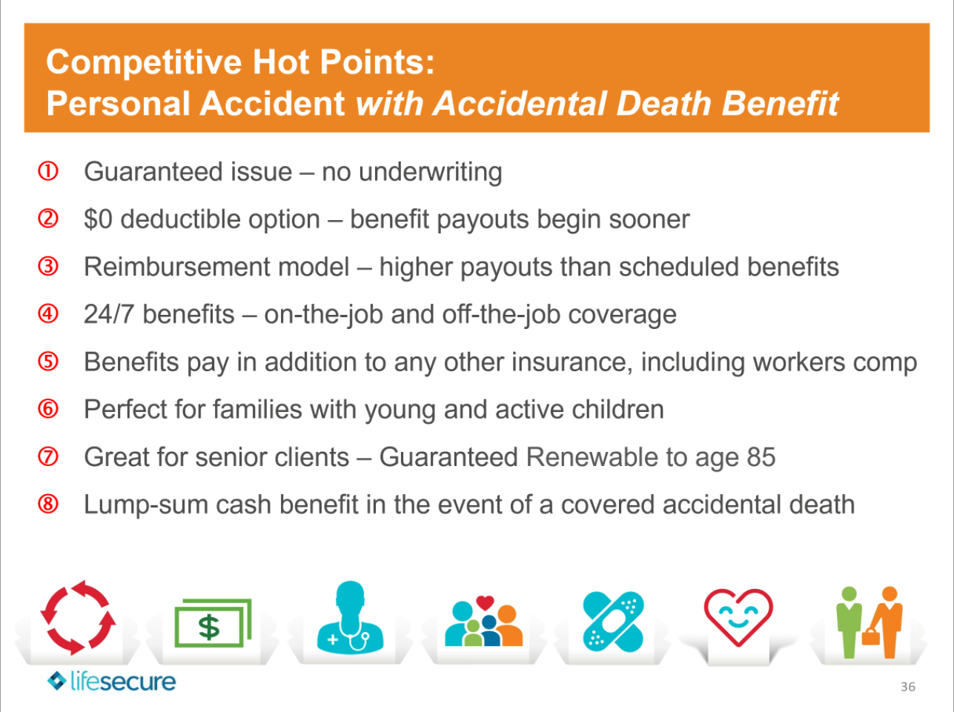

If you are accident prone, have active kids in sports, or have a more manual labor job, this is plan was made specifically for you! This plan is a great policy if you have a higher Health Insurance Deductible to get those bills covered. It’s a simple way to get reimbursed once you have had medical expenses due to ONLY an accident. By now you already know if this plan is a good fit for you, or someone in your family. So give us a call after giving this blog a quick read. Scroll all the way to the bottom to see some interesting statistics on activities by age that are likely to have an accident.

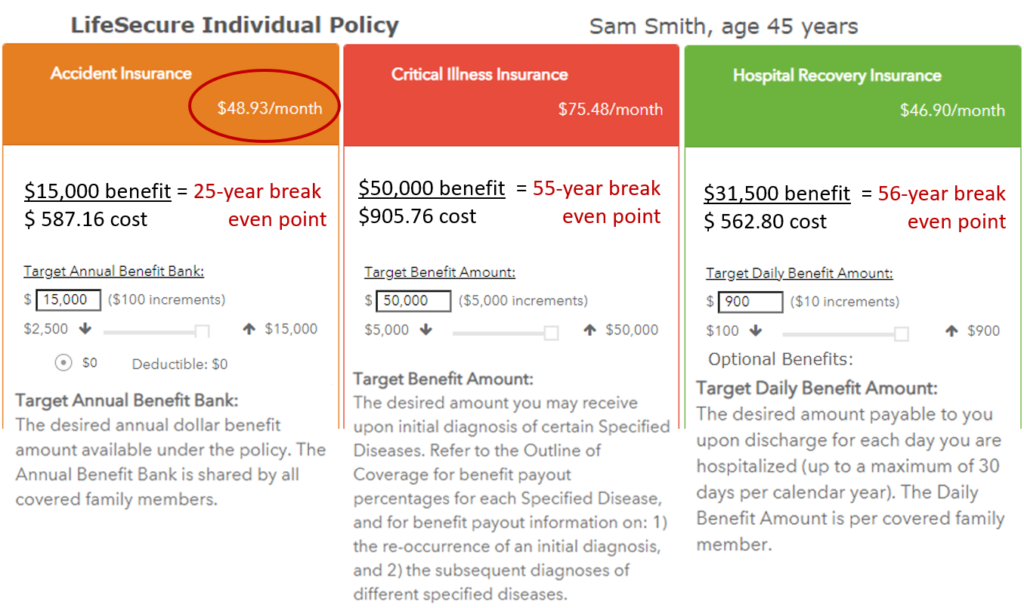

ENROLL HERE TO ENROLL in Accident Insurance, Critical Illness or Hospitalization Coverage

Call for a Quote at 425-802-2783 or email wahealth@heffins.com if you have any questions.

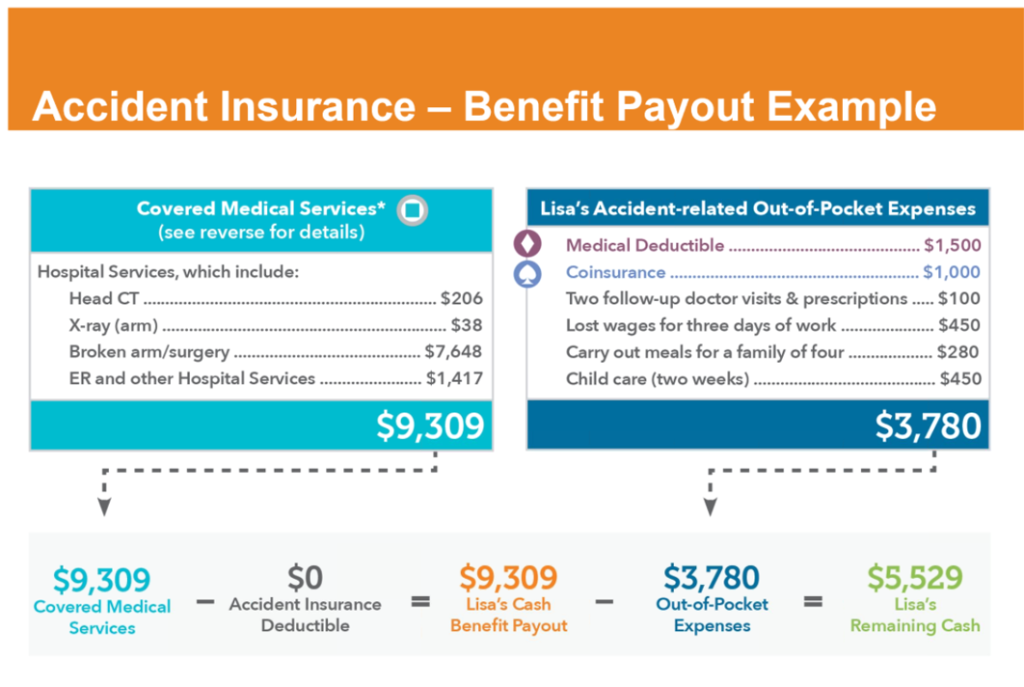

This Accident Plan is a direct reimbursement plan that is not linked to a health insurance plan, so it will pay up to the policy maximum. Due to the increasing prices of health insurance more people are getting a Bronze plan, yet being exposed to a $6,000 Deductible is a bit scary. This solution would help ensure that in an accident you would have extra financial protection. However, it will not cover ongoing illnesses, sicknesses, medications, or cancer. It’s only for those NEW acute injuries or accidents

Gary Franke, Tamara Chandler, Brianna Crawford & Melissa Tibbs

Heffernan Insurance Brokers

Individual Health & Medicare Specialists

1100 Bellevue Way NE, Ste 8A-545

Bellevue, WA 98004

425-802-2783 (call or text office line)

wahealth@heffins.com

www.wahealthplan.org

Accident Plan Coverage Examples

Sporting events are another activity where an accidental injury may occur. A baseball pitcher who develops a rotator cuff injury during the act of pitching would not qualify as an accidental injury. However a batter who is hit on the wrist by a pitch, which causes a fracture, has sustained an accidental injury. Joggers who develop ligament strain and tears during the course of their running routine have not suffered an accidental injury. However, if they misstep off a curb and fracture their ankle they have suffered an accidental injury. Clearly the demonstration of the “accidental” event within the course of normal participation in an activity can be made and an injury associated with that event would be covered if “care” as defined within the terms of the policy contract is provided. Payment of benefits is subject to all of the following:

- The Accidental Injury occurred while this Policy was in force

- Initial care must be received within One Week of the accidental injury.

- Claim must be made within 1 year of the Accidental Injury.

- Due Proof of Loss is provided

- Care for the Accidental Injury is received while this Policy is in force and within the US or Canada; and The Annual Benefit Bank is not exhausted.

- You must obtain and provide: copies of all itemized bills from the hospital, doctor, urgent care or accident service provider; and the Explanation of Benefits (EOB) from the primary insurance provider for each itemized bill. The EOB will be reviewed for any provider discounts that may have been applied to the charges; and copies of any medical documents which support the dates of service, treatment, diagnosis & explanation of how the accident occurred (e.g. ER Physician’s Report or physician’s office evaluation notes).

- Dollar-for-dollar reimbursement for: • Emergency Room • Hospital • Urgent Care Center • Surgery • Diagnostic Exams • X-rays • Physical Therapy